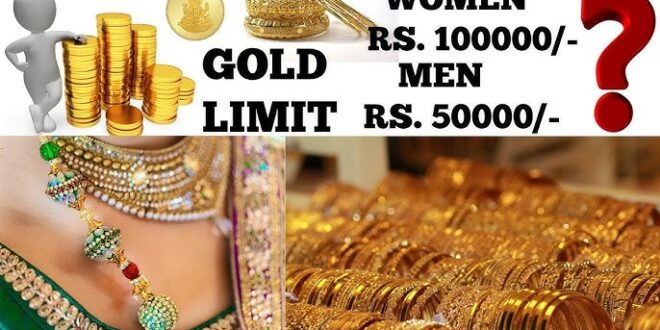

1. What is the duty-free gold limit for male passengers traveling from Dubai to India? Male passengers can carry up to 20 grams of gold jewelry without paying customs duty, provided the total value does not exceed Rs. 50,000.

2. What is the duty-free gold limit for female passengers traveling from Dubai to India? Female passengers have a duty-free gold limit of 40 grams, as long as the total value does not exceed Rs. 1,00,000.

3. How much gold can I bring to India without paying customs duty? If staying abroad for more than a year, male passengers can bring gold jewelry up to a value of Rs. 50,000 and female passengers up to Rs. 1,00,000 without paying duty.

4. Can I carry gold bars or coins within the duty-free allowance to India? No, the duty-free allowance applies only to gold jewelry for personal use and not to gold bars, coins, or biscuits.

5. What are the customs duty rates on gold exceeding the duty-free allowance? The customs duty rates on gold exceeding the duty-free allowance range from 3% to 10%, depending on the quantity.

6. How much gold is allowed from Dubai to India without duty for female passengers? Female passengers can bring up to 40 grams of gold jewelry without duty, provided the value does not exceed Rs. 1,00,000.

7. What is the maximum amount of gold allowed from Dubai to India? Travelers can bring up to 1 kg of gold from Dubai to India, but any amount above the duty-free allowance is subject to customs duty.

8. What is the customs duty on gold in India for 2024? As of the latest update, the customs duty on gold in India for 2024 has been reduced from 15% to 6%.

9. Are there any restrictions on the type of gold that can be brought into India from Dubai? Yes, gold bars and coins need to be declared and may attract customs duty, while gold jewelry within the allowance is allowed duty-free for personal use.

10. Is there a difference in the gold allowance for children traveling from Dubai to India? Yes, children are allowed the same duty-free allowance on gold jewelry as adults, provided they have stayed abroad for at least one year.

11. How is the value of gold calculated for customs duty in India? The value of gold for customs duty is calculated based on the current market price and the weight of the gold being carried.

12. Can I bring gold jewelry as a gift within the duty-free allowance? Yes, gold jewelry can be brought as a gift within the duty-free allowance limits for personal use.

13. What happens if I don’t declare gold that exceeds the duty-free allowance? Failure to declare gold that exceeds the duty-free allowance may result in penalties, including fines or confiscation of the gold.

14. How can I pay the customs duty on gold when arriving in India? Customs duty on gold can be paid in convertible foreign currency at the airport upon arrival in India.

15. Are there any exemptions for bringing gold into India for returning residents? Returning residents who have stayed abroad for more than six months can bring gold into India, but they must pay customs duty on amounts exceeding the duty-free allowance.

16. What should I do if I’m carrying gold jewelry worth more than the duty-free allowance? You should declare the gold jewelry at customs and be prepared to pay the applicable customs duty.

17. Can I bring gold coins or bars for personal use within the duty-free allowance? No, the duty-free allowance is applicable only to gold jewelry and not to gold coins or bars.

18. What documents are required for carrying gold into India? You may need to present purchase receipts, identification, and possibly a permit for carrying gold into India.

19. Are there any recent changes to the customs rules for gold in India? Yes, the customs duty on gold has been reduced, and it’s important to check the latest regulations before traveling.

20. How can I ensure a smooth process when bringing gold into India? Ensure you have all the necessary documentation, declare your gold at customs, and be aware of the duty-free allowance and customs duty rates.